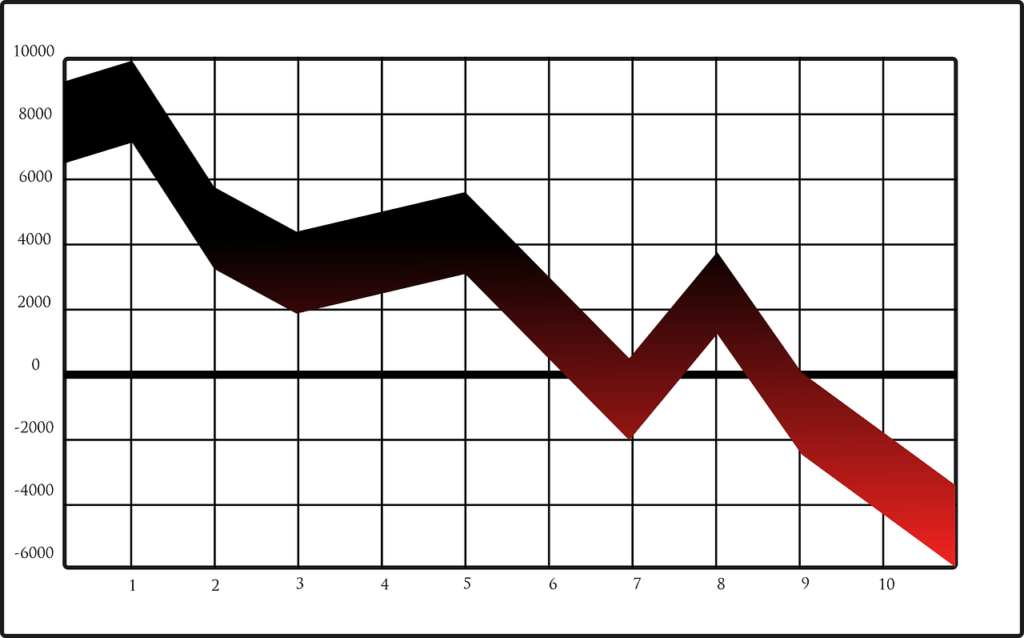

In a significant development for the Indian telecom sector, Vodafone Idea saw its shares crash by approximately 15% after the Supreme Court of India rejected the company’s plea regarding Adjusted Gross Revenue (AGR) dues. This decision has sent shockwaves through the market and raised concerns about the financial health and future viability of the telecom operator.

What Led to the Crash?

The Supreme Court upheld its earlier ruling that telecom companies must settle their AGR dues, a long-standing legal and financial issue that has plagued the sector. For Vodafone Idea, this ruling is particularly critical as the company has been struggling with mounting debts and competitive pressures. The rejection of the plea means that Vodafone Idea will need to find ways to address its substantial financial liabilities, which could further strain its resources.

Understanding AGR Dues

AGR refers to the revenue used by telecom operators to calculate their licensing fees and spectrum usage charges. This has been a contentious issue in the Indian telecom industry, with several operators disputing the calculations and seeking relief from the government. The Supreme Court’s ruling reinforces the government’s stance, making it clear that telecom companies, including Vodafone Idea, are expected to fulfill their financial obligations.

Market Reaction

The market’s response was swift and severe. Following the announcement, Vodafone Idea’s shares plummeted, reflecting investor anxiety regarding the company’s ability to navigate its financial challenges. The drop highlights a growing lack of confidence among investors, particularly as Vodafone Idea has already been struggling to compete with larger players in the industry, such as Reliance Jio and Airtel.

Financial Health of Vodafone Idea

Vodafone Idea has been in a precarious position for some time, grappling with high levels of debt and operational challenges. The company has seen its subscriber base shrink as customers migrate to competitors offering more attractive pricing and service options. The burden of AGR dues adds another layer of complexity to its financial situation, making it increasingly difficult for the company to recover.

What Lies Ahead for Vodafone Idea?

As the company faces these mounting pressures, the focus will be on its next steps. Analysts suggest several possible strategies that Vodafone Idea could consider to improve its financial health:

- Raising Capital: The company may look to raise funds through equity or debt offerings to alleviate its financial burden and invest in network upgrades.

- Strategic Partnerships: Forming alliances with other telecom operators or tech companies could provide much-needed support and resources.

- Cost-Cutting Measures: Implementing operational efficiencies and cost-reduction strategies may help stabilize the company in the short term.

- Customer Retention Initiatives: Developing attractive plans and enhancing customer service could be crucial in retaining its existing subscriber base and attracting new customers.

Conclusion

The recent Supreme Court ruling and subsequent share crash for Vodafone Idea underscore the volatile nature of the telecom industry in India. As the company navigates these challenging waters, stakeholders will be watching closely to see how it adapts and responds to the ongoing pressures. For now, Vodafone Idea’s future remains uncertain, but its ability to manage its AGR dues and financial health will be pivotal in determining its survival in this highly competitive market.

Leave a Reply